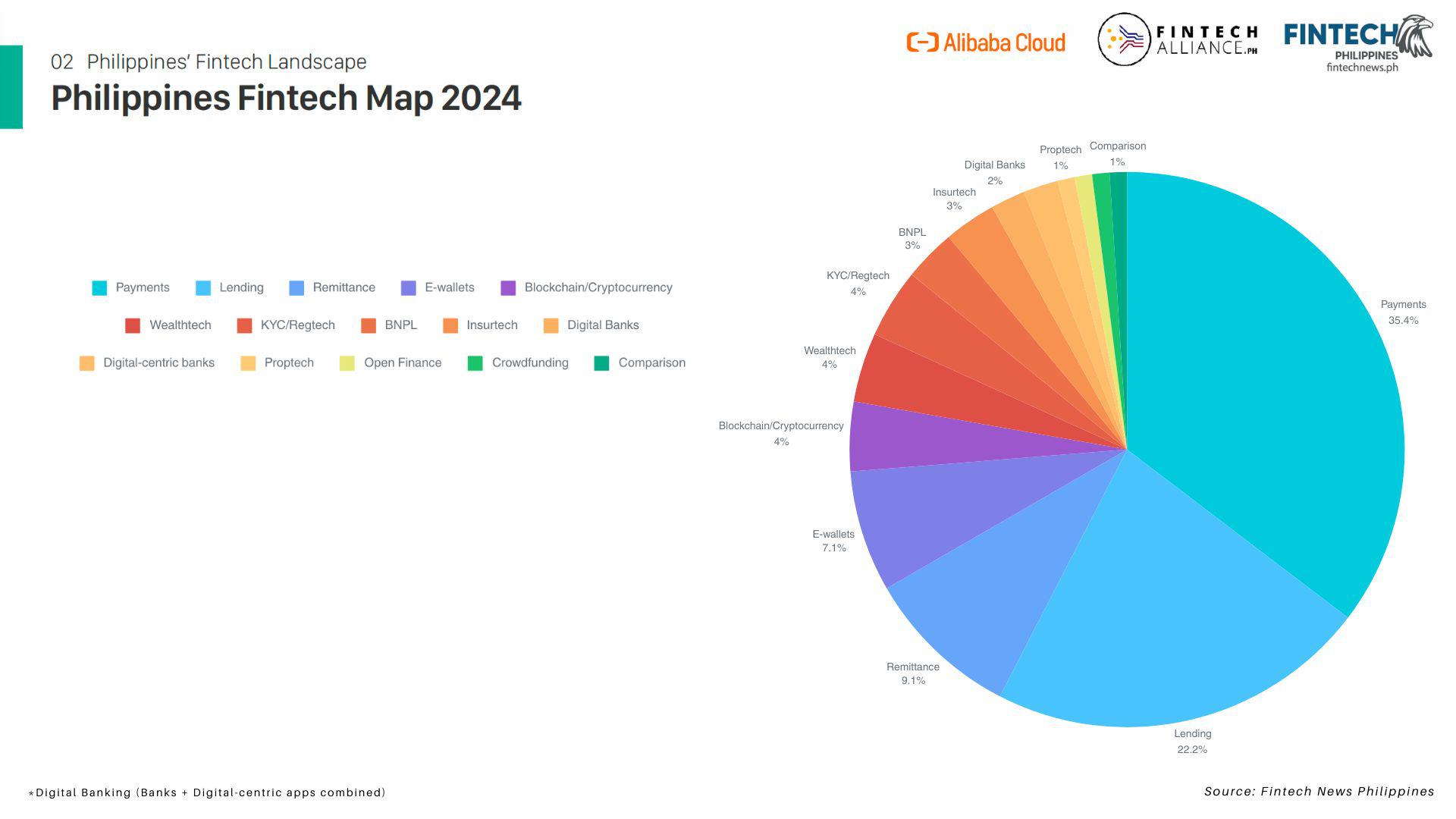

Philippines Fintech Map 2024: Sector Distribution and Key Growth Areas

The Philippines Fintech Map 2024 image highlights the distribution of various fintech categories in the Philippines, illustrating the significant areas of growth and focus on the industry. Here’s a breakdown of the key insights:

- Payments (35.4%): The largest sector within the fintech landscape, indicating the dominance of payment processing platforms and solutions. This includes digital wallets, mobile payments, and other related services.

- Lending (22.2%): The second-largest category, highlighting the expansion of digital lending platforms, which are addressing the need for accessible credit, especially in underserved sectors.

- Remittance (9.1%): Remittances play a vital role in the Philippines, given its large overseas workforce. Digital solutions in this sector are growing to streamline and lower costs for cross-border money transfers.

- E-Wallets (7.1%): Reflecting the increasing popularity of mobile wallets such as GCash and Maya, which have become crucial for daily transactions, particularly in retail and online shopping.

- Blockchain/Cryptocurrency (4%): Though still emerging, blockchain technology and cryptocurrencies are gaining traction, particularly in remittances, payments, and investments.

- Insurtech (3%): The sector is growing, driven by digital insurance solutions aimed at providing affordable and accessible products to a wider audience.

Other notable categories include BNPL (Buy Now, Pay Later), Wealthtech, KYC/Regtech, and Digital Banks, each occupying 2% to 4% of the fintech ecosystem.

This distribution emphasizes the Philippines’ focus on financial inclusion, innovation in payment solutions, and addressing the needs of the unbanked and underbanked population

Source: https://fintechalliance.ph/philippines-fintech-report-2024/