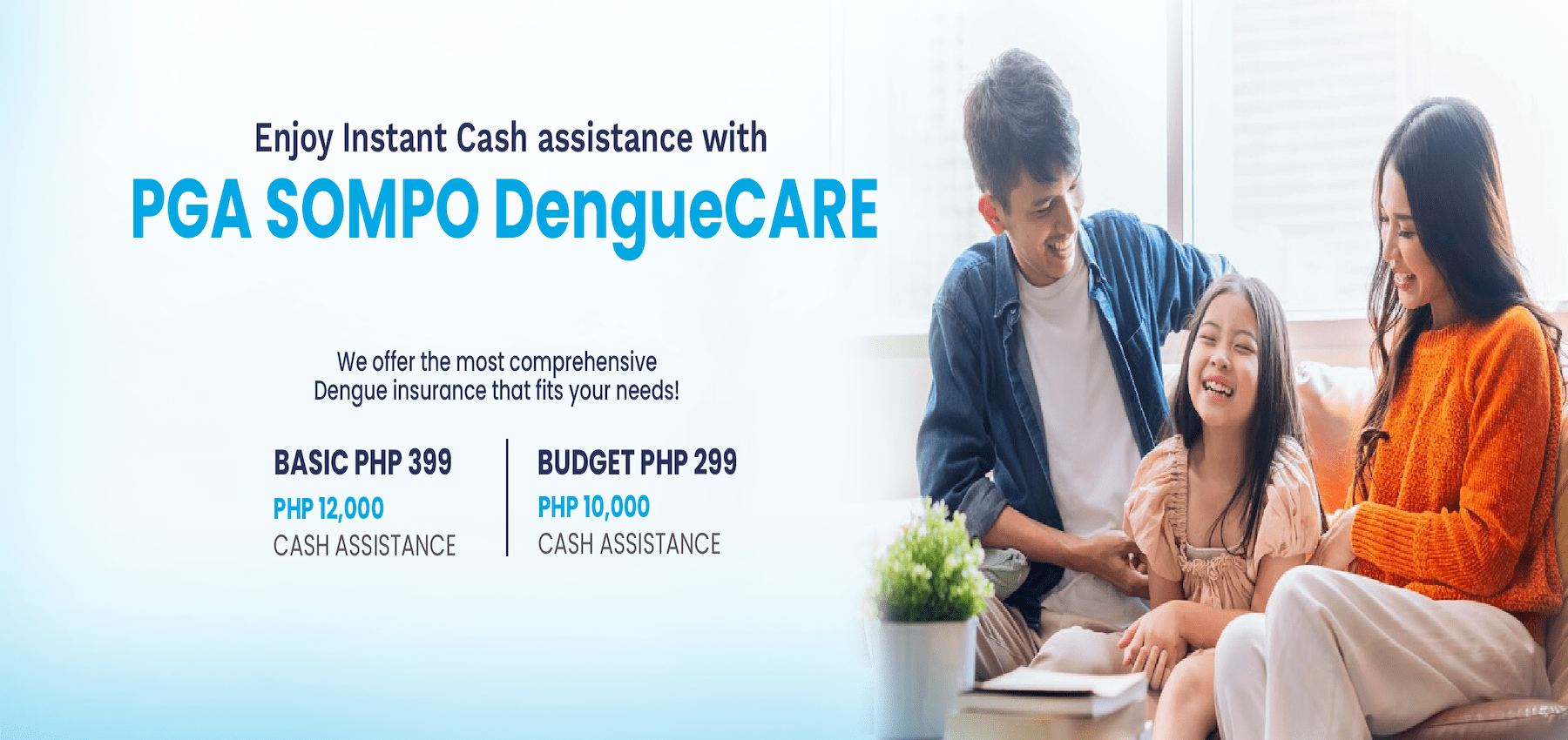

Dengue Insurance: Buy a plan that saves you from going out of pocket!

As dengue cases rise in the Philippines, an insurance plan becomes increasingly important to protect yourself from unexpected spends. While prevention is key, having insurance can provide financial support if infection occurs.

Why a Dengue Insurance Plan?

Dengue can lead to serious complications, hospitalization, and time off work. A dengue insurance plan helps cover medical expenses and income loss, easing the financial burden.

Key Benefits of Dengue Insurance:

- Hospitalization and Medical Coverage: Covers treatment, consultations, and tests related to dengue fever.

- Income Protection: Provides support if unable to work due to illness.

- Emergency Assistance: Ensures access to healthcare and supplies when needed.

- Affordable Premiums: Accessible plans with flexible payment options.

Choosing the Right Dengue Insurance Plan

- Coverage Limits: Ensure the plan covers all medical expenses.

- Exclusions and Terms: Understand any exclusions or limitations.

- Additional Benefits: Look for income protection or healthcare access.

- Claims Process: Choose an insurer with a transparent claims process.

Combining Dengue Insurance with Prevention

Dengue insurance should complement preventive measures, such as eliminating stagnant water and using repellents. Together, they provide comprehensive protection.

Conclusion

It’s an affordable cover and works as a living benefit!

For more details, visit https://jomer-network.surely.digital/