How GCash’s credit and insurance tools unlock Philippines’ inclusion barriers

GCash, a leading digital payment app in the Philippines, is advancing financial inclusion in a country where only 25% of people have bank accounts. Ingrid Beroña, GCash’s chief risk officer, highlighted efforts to remove financial barriers and provide access to services for every Filipino.

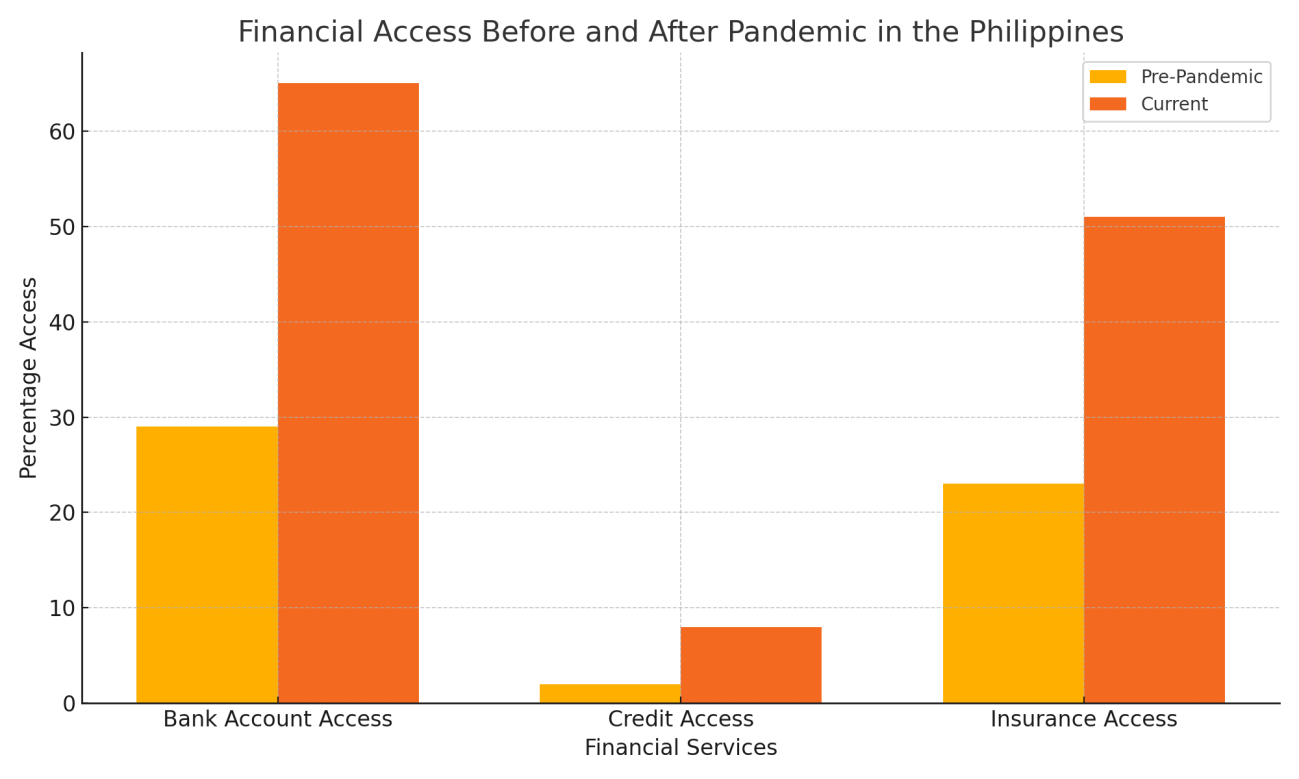

Before the pandemic, only 29% of Filipinos had bank accounts and just 2% had credit access. Today, 65% of Filipinos have bank access, 8% have credit, and 51% now have insurance, up from 23%.

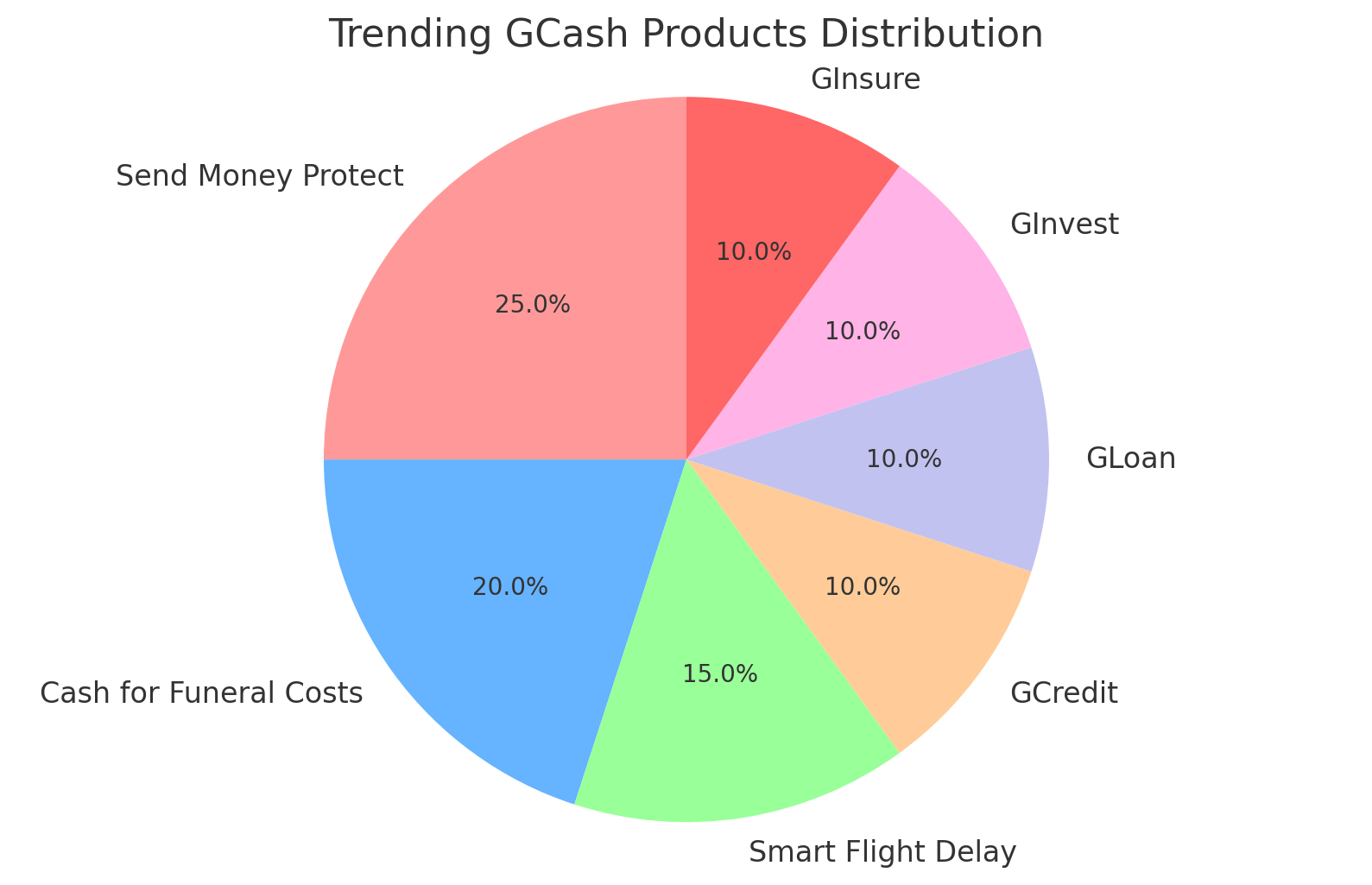

GCash provides a wide range of financial services, including GCredit, GLoan, GInvest, and GInsure. Its GScore system helps users access credit without traditional collateral. GCash supports MSMEs through GCash for Business and offers a marketplace, GLife, for merchants to reach millions of users.

In insurance, GCash’s GInsure provides affordable coverage starting at ₱30 per month, with over 7.8 million subscribers. Recent products like Send Money Protect, Cash for Funeral Costs, and Smart Flight Delay are top sellers.

To ensure security, GCash has introduced features like facial recognition and a one-device-per-account rule. The company also plans to expand its offerings with new investment options like bonds.

Beroña sees GCash’s progress as transformative, marking the start of a revolution in financial engagement for Filipinos.

Source: https://insuranceasia.com/insurance/event-news/how-gcashs-credit-and-insurance- tools-unlock-philippines-inclusion-barriers